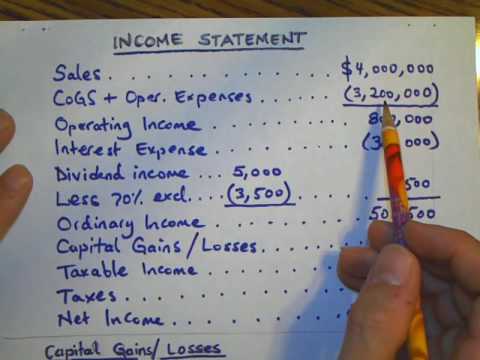

Hello everyone today we will be solving an example about the corporate income tax computation in this example we have a company, and we know some financial information about that company related to the previous year, and we need to compute the income statement today we need to complete the tax liability of that company and the best way to do it is to prepare an income statement as we know the income statement tells us about the net income of the corporation but along the way we will be able to compute the tax liability of this corporation as well so in the best way to deal with problem like this is to understand the problem first, and I want you gusto read this problem carefully and you will see that we are given very valuable information about this company in the in this given text and I will go ahead and underline some keywords that will be very important in solving this problem this example ok so as you can see the very first key word will resales here the company had four million dollars of sales in the previous year awe are preparing an income statement forth previous year as you know the other key words that I realize is the combined cost of goods sold so the cost of goods sold and the operating expenses these are also very important, so these will Bates in the income statements of our corporation, and we also see the interest expense which we need to deduct as you remember if there is a cost or an expense we need to make a deduction andlike the operating expenses or the cost of Goodall these will all be deducted from the sales okay from our sales all right andhere'’s another additional...

PDF editing your way

Complete or edit your company tax return 2019 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2019 corporate tax return directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your corporation tax return 2019 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs form 1120 2019 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 1120 Online

About Form 1120 Online

Form 1120 Online is a tax form used by corporations in the United States to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). It is the U.S. corporate income tax return and is used to determine the amount of federal taxes the company owes. Corporations that are required to file Form 1120 include those that have been incorporated domestically or abroad, limited liability companies classified as corporations for tax purposes, and foreign corporations engaged in business in the United States. Certain types of corporations, such as S corporations, are not required to file Form 1120. Form 1120 must be filed annually and is due on the 15th day of the 4th month following the end of the corporations tax year. It can be filed online using specialized software or with the help of a tax professional.

What Is Form 1120?

The 1120 Form is for the entities separated from their shareholders. If a corporation is a separate entity, it’s owners don’t pay the taxes, but a corporation pays income fees by filing tax return. By reporting your income, gains, losses, deductions and credits, you may figure your tax liability as well. Charges should be paid to the Internal Revenue Service according to the requirements indicated by this return. To facilitate the process use a fillable template that is available online.

Here you can easily fill out, correct, download, print and send your files. Read through the following instructions before the completing.

There are four main sections in the form, that should be filled out with the information below:

- Basic data: name and address of your corporation, Employer ID (EIN), date of incorporation and total assets.

- Determining the category of your income (gross receipts, cost of goods sold, dividends, interest, rents, royalties, and capital gains).

- Information concerning the officer compensation, salaries, wages, rents, bad debts and other documentation that should be provided in case of an audit. All deductions and tax-deductible expenses should be included.

- All refund or underpayment amounts.

Some schedules are required to attached if the respective information is listed on the return. The final documents must be submitted by the 15th day of the 4th month after the end of its tax year.

Online remedies help you to to prepare your document administration and boost the productivity within your workflow. Comply with the short manual for you to carry out Form 1120 Online, keep clear of problems and furnish it in a very timely fashion:

How to finish a Irs Form 1120?

- On the website with all the variety, click Start Now and pass into the editor.

- Use the clues to fill out the appropriate fields.

- Include your own knowledge and contact data.

- Make certainly that you just enter correct facts and quantities in applicable fields.

- Carefully take a look at the articles of your type as well as grammar and spelling.

- Refer that will help portion when you have any issues or handle our Support group.

- Put an electronic signature on your Form 1120 Online along with the support of Sign Instrument.

- Once the form is concluded, push Done.

- Distribute the completely ready variety through e-mail or fax, print it out or help you save on your system.

PDF editor will allow you to definitely make adjustments towards your Form 1120 Online from any net connected equipment, customize it according to your preferences, indicator it electronically and distribute in numerous options.

What people say about us

Reasons to use electronic digital forms or paper records

Video instructions and help with filling out and completing Form 1120 Online